Life insurance is something people do not consider until later in life, but it is best to insure yourself early on- in your 20s when you are in perfect health. Especially if you have dependents, have aging parents, work at a high-risk job or practice extreme hobbies. If you plan to start a family or pay off a loan, or mortgage that’s reason enough to get life insurance.

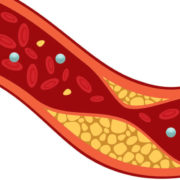

You may need life insurance even if you are in perfect health because the chance of developing chronic diseases like diabetes, heart illnesses, breast cancer, and other types of cancer increases if you have a high-risk lifestyle. Health insurance can help cover the cost of rising medical expenses, and a medical emergency can impact an individual at any age, which can be emotionally and financially draining.

Life insurance can ensure your child’s future to compensate for unexpected death’s inevitable financial consequences due to life-threatening diseases such as cancer. Life insurance for children can be beneficial for their future health and long-term financial planning. The purpose of life insurance is that the death benefit is sufficient to cover expenses and outstanding obligations such as funeral costs, medical expenses, educational and other costs so that the family does not struggle after the breadwinner’s death.

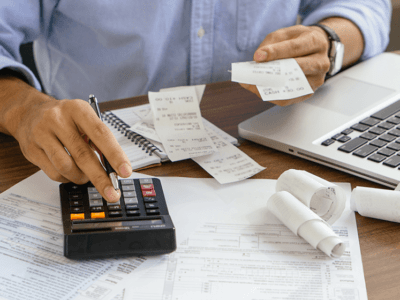

Health insurance can help pay for medical expenses such as doctor’s visits, medications, tests, procedures, and hospital stays. People often do not consider buying life insurance because of the cost; however, its coverage is pretty affordable. Also, the younger and healthier you are, the lower the premiums. If you are in perfect health and do not have any preexisting or hereditary health condition, your premiums’ cost is easily affordable.

Suppose your occupation is high-risk level, such as jobs in aviation, firefighting, construction, mining, in the sports field, or pursue a dangerous hobby. In that case, you can add a disability clause to your life insurance policy.With the lifestyle that millennials are pursuing, mental stress, anxiety, unhealthy eating habits, and addictions can lead to chronic diseases. You can even add a rider that includes the accelerated death benefit, which lets you access your death benefit while you’re alive but suffering from a terminal illness such as cancer so that you can pay for medical expenses.

Applications for life insurance have been on the rise since the onset of the coronavirus pandemic. During the first half of 2020, people in perfect health also applied for life insurance, an increase of 1.5% from the previous year. Some parents have concerns about their children’s long-term health due to hereditary diseases, and life insurance can provide long-term peace of mind for you and your loved ones. You can be prepared for any eventuality,knowing that your family has protection in place should something happen to you.

Deciding on the best life insurance policy will depend on your age, occupation, situation, what stage of life you are in, and why you want life insurance. You can be in perfect health, but pregnancy can be life-threatening, death due to accidents are common, and the use of carcinogenic products is on the rise. Remember, your life insurance becomes more expensive the older you get, and with life being so unpredictable, it is advisable to buy life insurance early on.

Comments