As health care becomes increasingly costlier, health insurance becomes a necessity. That said, health insurance is not easy to comprehend. Nevertheless, there are many benefits associated with health insurance.

Understanding Health Insurance

What is health insurance? Health insurances pay for your medical care. It covers a wide range of health-related services including routine checkups, major illness treatments, and associated medical costs. As a health insurance holder, you pay a monthly fee referred to as Premium. You might be required to cover some of your medical costs every time you are attended to even if you got health insurance.

Before you visit a health facility in Melbourne, Australia you should ensure your Health insurance is accepted there.

The Importance of Health Insurance

There is no doubt that health insurance is important. The medical costs covered by health insurance could eat into your savings. Further, there are tax benefits associated with medical insurance. The following are some of the reasons why health insurance is important.

- It protects savings: In Australia, so many people have cumulatively saved millions through health insurance. Highly specialized treatment and unpredictable emergencies are quite expensive. Without medical insurance, these high costs can deplete your savings to the last coin. However, health insurance reduces the amount of money you would have spent out of your pocket.

- Covers medical costs incurred: Most health insurance policies cover not only the inpatient medical bill but other associated medical costs. The costs include those incurred during and after hospitalization.

- High-quality treatment: Most medical insurance covers have partnered with extensive health facilities and medical clinics in Melbourne, Australia. As an insurance coverage holder, you and your family can receive treatment at all these facilities. The insurance company pays the hospitals and health facilities later on.

- Covers your entire family: You do not only get health insurance for yourself but your entire family. The family cover is packaged as a policy for either the nuclear family –spouse and children or the parents. You can choose the best one for your family.

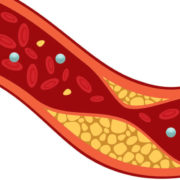

- Protection against major lifestyle conditions: There has been a rise in lifestyle diseases such as diabetes, heart problems, etc. The predisposing factors leave most families susceptible. Their medical treatment is expensive. But with health insurance, the heavier burden is lifted saving more money on health-related issues.

How Do You Use Your Insurance Policy For Medical Benefits?

It’s good to note that all health insurance is not designed similarly. Every insurance company offers different terms and conditions. You need to look out for the benefits and limitations. Normally, the insurance companies will provide a list of hospitals, medical facilities, and doctors where you need to be treated.

Ensure that your most preferred health facilities or personal physicians are listed by the Health insurance policy of choice. Every time you visit a medical facility, you’ll provide your health insurance information before receiving medical care. The doctor will bill the insurance company through the information you’ve provided.

The insurance company will provide a card to prove you have an updated health insurance policy. The doctor uses the card to bill the insurance company

Comments